According to a recent industry report, “Behavioral health is the fastest-growing segment in healthcare, outpacing all other specialties in spending growth.” * That growth brings opportunity, but it also brings a level of billing and compliance complexity that surprises even seasoned healthcare revenue cycle leaders.

The Opportunity

In an often-quoted 2025 report by Precedence Research, the U.S. behavioral health market is projected to grow from $94.82 billion in 2025 to approximately $165.38 billion by 2034, reflecting a compound annual growth rate of 6.4%. That’s remarkable growth, especially in today’s volatile healthcare landscape. CMS has also increasingly identified behavioral health as a priority growth specialty within its evolving care models. Although behavioral health is one of the fastest-growing specialties in healthcare today, it is also one of the least understood from a revenue cycle perspective. It’s not just therapy sessions and psych evals anymore. This is a highly regulated, multi-payer, multi-modality service world that often blends clinical care with social services, housing support, substance use recovery, and developmental disability programs, each with distinct billing rules and compliance risks.

Although behavioral health is one of the fastest-growing specialties in healthcare today, it is also one of the least understood from a revenue cycle perspective.

With increased awareness, reduced stigma, and a rising demand for mental health services, this specialty is finally getting the attention it deserves. But on the back end, in the billing office, it’s a very different story.

A Different Kind of Complexity

Revenue cycle teams have traditionally billed for psychiatric care delivered by MDs and DOs, psychological services provided by PhDs, and have more recently expanded into integrated behavioral health (IBH) programs relying on other licensed professionals. It’s easy to assume that expanding into the broader behavioral health domain, where much of today’s new funding is being directed, would be a smooth transition. Fewer procedures, minimal devices, rare complications – that’s what most leaders expect. Sounds like Primary Care? Think again. The reality is far more complex.

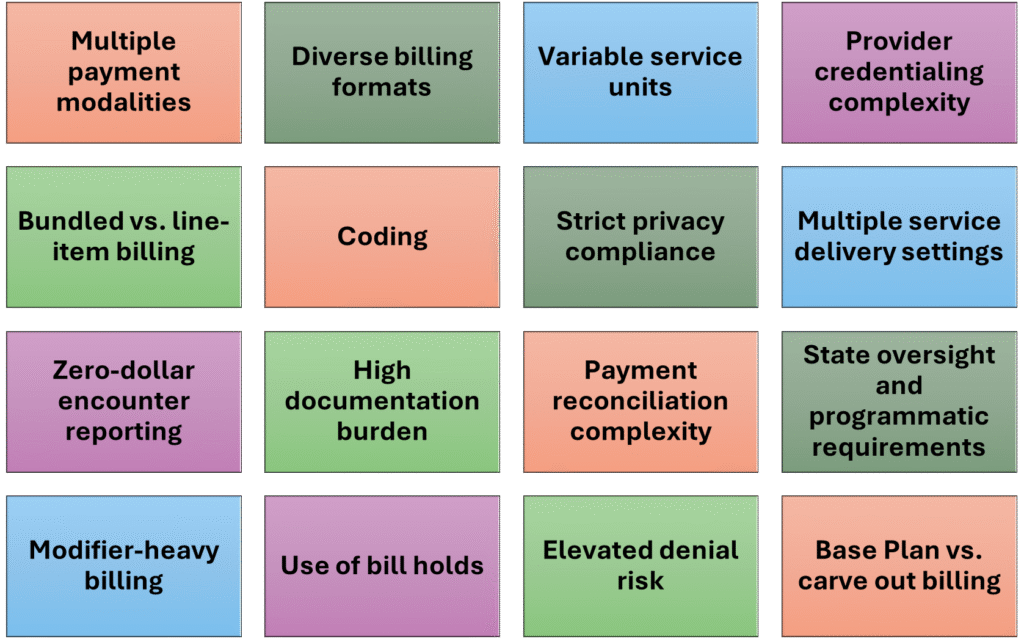

As noted, behavioral health spans a wide range of services, including prevention, diagnosis, and treatment of mental health conditions, developmental disorders, substance use disorders, and social work interventions. Each area comes with its own complex billing requirements, and programs must be prepared to support them. As the chart below illustrates, this makes behavioral health billing uniquely intricate. Here are just a few of the challenges agencies in HFMA Region 1 must navigate:

Among the numerous questions a billing analyst must therefore address when setting up a BH service are:

- What is the reimbursement modality? Fee-for-service, capitation, grant/contract billing, and ACO/shared savings are all common.

- What are the state oversight and programmatic requirements? Companies must meet unique operating and reporting standards from DMH, BSAS, DDS, and other state agencies as seen in Massachusetts, for example.

- What claim form or billing format is needed? Note that 837P (CMS-1500), 837I (UB-04), paper claims, and manual/spreadsheet-based billing are simultaneously used in larger agencies.

- What is the basic unit of service? Time-based, procedure-based, encounter-based, or dose-based billing units are reported, depending on service and payer.

- Will the activity be billed on a bundled, per diem, or procedural basis? Each approach is currently used across Massachusetts and throughout Region 1.

- What will the service delivery format be? Individual, group, residential, telehealth, and multidisciplinary/team-based care each have different billing rules.

- What are the provider credentialing requirements? Behavioral health involves a broad spectrum of provider types: MDs, PhDs, LMHCs, LICSWs, LADCs, NPs, and paraprofessionals, each with different billing privileges and supervision requirements.

Add to this, carve-out billing arrangements and stricter privacy regulations (like 42 CFR Part 2), and it’s clear why behavioral health stands apart as one of the most complex specialties in the revenue cycle.

Why This Matters Now

As more providers expand their behavioral health services, including via telehealth, a specialized, streamlined revenue cycle is essential. Inefficient billing practices not only lead to lost revenue but also reduce patient access, increase provider burnout, and contribute to higher turnover at both the program and organizational levels.

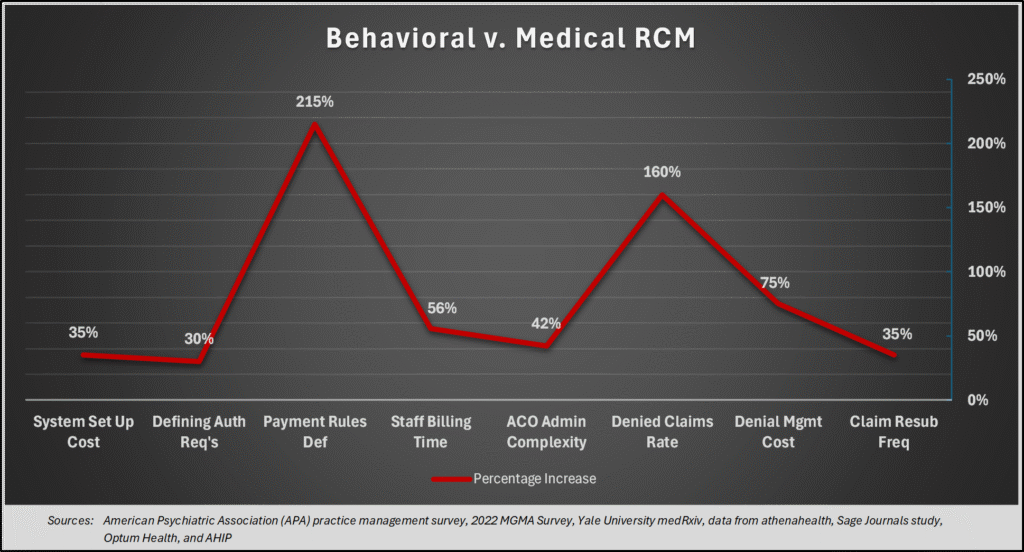

Additionally, providers with suboptimal revenue cycle management (RCM) processes often face a significantly heavier administrative burden. Industry surveys and peer-reviewed research consistently show that behavioral health billing requires more time, effort, and expense to design and maintain a functional billing matrix. As the chart below illustrates, defining billing and authorization requirements—and managing claim forms—is considerably more resource-intensive in behavioral health than in most medical specialties. This complexity drives higher overhead costs compared to general medical practice.

* See HHS OIG March, 2024 Brief Number: OEI-02-22-00050; McKinsey & Company, 2022 Behavioral Health Report

Have you encountered challenges in behavioral health billing? I’d love to hear how your organization is navigating this evolving landscape. Feel free to leave a comment or connect with me on LinkedIn.